The economies of countries around the world are facing, periodically, with cyclic evolutions, economic crises, shocks generated by factors exogenous to the economic system, as it is happening now. All these evolutions have as common denominator the need of policies capable of supporting the economy and make the necessary corrections, according to the imbalance. However, solutions must be identified accurately and adapted to the real causes of the crises, otherwise the treatment will fail.

15 years and 2 crises in economic maps – since Romania’s accession to the EU

The analysis in question reflects the preoccupation to draw a comparative picture as comprehensive as possible, for all the countries in the EU, and to emphasize the directions and perspectives of Romania’s economic consolidation in the present context of the corona-crisis.

In this respect, we used a series of statistic data for the EU countries, regarding the economic growth, current account balance, budget deficit, public debt, and also budgetary adjustment as effort to consolidate public finances. The time frame taken into consideration is 2007-2021, so since the beginning of Romania’s presence in the EU.

The graphic method utilized consists of grouping the EU countries according to performances recorded and highlighting of the hierarchy of the member states on each index and for each of the years studied. Thus, evolutions can be tracked in dynamic, through the progress or regress of the member states in the annual rankings if the Union.

The statistic data is extracted from the EUROSTAT and AMECO bases. In Romania’s case, the numbers from 2020 and 2021 reflect national estimations, done by CNSP.

The map of the economic growth and the terminals of the two crises

As far as economic growth is concerned, the performances of the EU countries are represented by annual rankings and by grouping them into performance categories. Thus, the map of the economic growth in the Union in the time frame 2007-2021 clearly highlights the years in which the crises culminated, respectively 2009 and 2020. In these years, the economic downturn was practically generalized, with only one European exception- Poland.

According to the selected performance intervals, we can draw a few conclusions:

- During years 2008-2013, the EU countries record economic downturns or moderate growths, but during the next 6 years, in the interval 2014-2019, the economic growth in the European space extended and consolidated, as a phase of economic expansion.

- In 2020 – the year of the COVID-19 pandemic, the severe economic downturn manifests in almost all countries of the EU, unlike the crisis in 2009, when the numbers of the countries with a significant downturn of the GDP, of over 5%, was relatively lower.

- Italy, Croatia, Spain, Portugal, Greece were the most affected countries in the crisis in 2008-2009, by economic downturns recorded in several years, while their comeback was relatively slow, but progressive, starting with 2013 and 2014.

- Romania recorded, during the previous crisis, severe economic downturns, of -5,5% in 2009 and -4% in 2010, when the austerity measures were applied. But, starting with 2012, Romania moved towards the top of the European rankings.

- Between 2013 and 2019, Romania evolved constantly on “blue”, with high rates of economic growth, in 2016 being on the second place in the European ranking, but in 2017 the rhythm of the economic growth slowed down constantly, to 4,1% in 2019.

- Starting with 2015, excepting Greece, all EU countries recorded an economic growth, but the group of countries with an economic growth of over 3% decreased progressively starting with 2017 until the emergence of the sanitary crisis in 2020.

- Greece was the country with the weakest performances, with a severe economic downturn on the course of 5 years of presence in the lower part of the rankings. On the other hand, Ireland was the champion of the economic growth, also with 5 years of presence in the top of the rankings.

- Unlike the 2008-2009 crisis, the economic downturn in 2020 intervened suddenly and almost uniformly for all EU countries, with similar manifestations in certain sectors, given the sanitary crisis and the lockdown measures in the economy.

- For the year 2021, the prognosis show a pretty consistent economic growth, with growth rates of over 3% for almost all EU countries, which indicates – in the case of their materializations, a first significant difference from the 2009 crisis.

These punctual observations regarding the quantitative performances must be nuanced, however, through the prism of the policies and macroeconomic imbalances, which make us question, in some cases, even the sustainability of the economic growth.

In Romania, for example, the policies in the years 2015-2019, excessively focused on the stimulation of consummation through fiscal relaxation and the increase of permanent expenses, supported a preponderant quantitative economic growth, lacking however in the qualitative intake of the investments and of the structural reforms.

In this respect, the spectrum of the macroeconomic imbalances is an essential factor in judging the quality of the policies. How it comes to a crisis is especially important, the policies with which you enter a stage of crisis, but also the way you overcome the crisis and therefore the policies for the economic recovery.

Sometimes, out of a (political) desire to obtain “much and fast”, policy-makers get the direction and/or dosage wrong. Thus, the anti-crisis policies can suddenly become pro-cyclical policies, and the recovery policies can even bring the braking of the economy.

The map of the current account and structural imbalances

In the long-term evolution of an economy, the current balance account is the most comprehensive macroeconomic sustainability index. The situation of the current account shows us if an economy consumes more than it produces, and therefore lives on a debt, or if it gathers “wealth” through surpluses in the payment balance. To not be understood, however, that current account deficits are by definition undesirable. The problem is them becoming permanent along the economic cycles.

- Until 2012, in the European Union prevailed the current account deficits, but afterwards the situation became balanced, and the current account surpluses manifested in particular, the EU average being on “green” for almost the whole period of time.

- The group of the Northern countries, Sweden, Denmark, Netherlands, to which we add Germany, Austria accumulated current account surpluses along all the 15 years, despite the two crises and the cyclic economic evolutions.

- Greece, Cyprus, Great Britain, France and Romania are the countries that accumulated current account deficits, mentioning that Romania is defined by the longest period of time of being “on the red”, in 10 out of 15 years.

- In the case of Romania, but not only, the persistence of current account deficits goes hand in hand with the big budget deficits, which explains the paradigm of “twin deficits” which have been characterizing us since 2016.

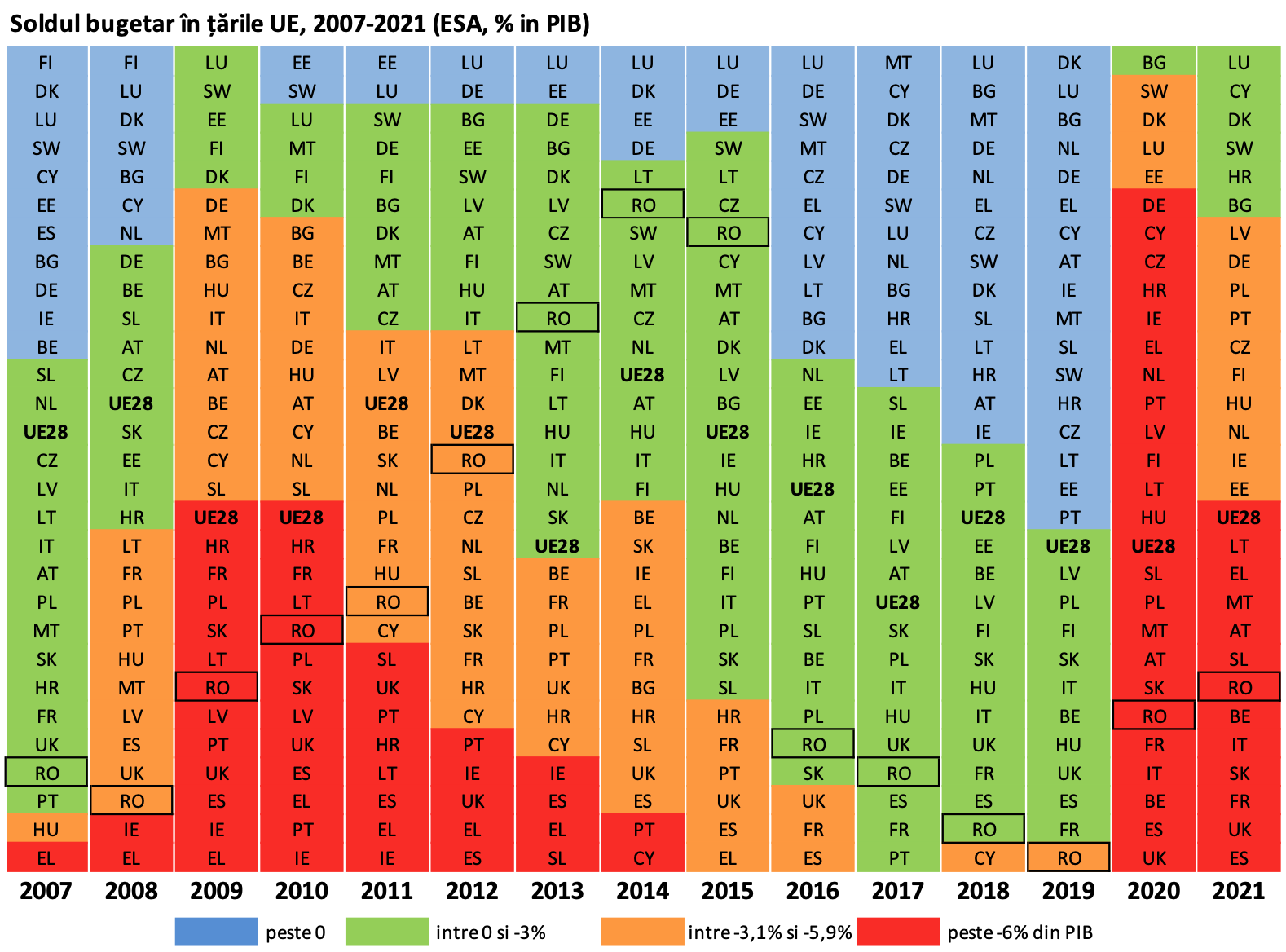

The map of the budget deficit and the slope of fiscal consolidation

Both crises left their mark on the macroeconomic imbalances, out of which the budget deficit is by far the most sensitive index, as shows the situation of the public finances represented in the map below.

The map of public finances clearly illustrates the impact of the two crises on the budget deficit. We notice that, in the context of the financial crisis, the deterioration of the budget balance intervenes since 2008 and becomes much more emphasized in 2009.

In return, the corona-crises put almost all the budgets of the EU states “on the red”, after a 2019 in which only Romania did not respect the threshold of 3% budget deficit, according to nominal convergence criteria.

- The “red-orange” pyramid, elongated to the right, shows the slope of fiscal consolidation, which begins in 2010 and goes down progressively for 6-7 years. 2017 is the first post-crisis year when all EU countries match the 3% budget deficit criteria.

- Greece, Ireland, Spain, Portugal, Great Britain are the countries with the most severe budget deficit and for the most years, in the context of the financial crisis in 2009, which also explains the burden regarding the public debt, which became stringent.

- The Northern countries, Sweden, Finland, Denmark managed to respect the 3% budget deficit threshold even in the context of the financial crisis, while the Southern countries, France and Spain, performed with excessive deficit until 2016.

- Italy, under the burden of public debt, made a comeback since 2012 for respecting the 3% GDP deficit threshold, along with countries like The Czech Republic, Austria, Hungary, which constantly maintained the trajectory of fiscal consolidation.

- Germany, starting since 2012, recorded a budget surplus for 7 years, the strongest performance of this sort, together with Northern countries and Estonia, country with six years of budget surplus and in the top of post-crisis economic growth.

- Romania stayed “on the red” for two years, with a budget deficit of over 6% of the GDP, and the next two years (2011 and 2012) on “the orange”, with budget deficits of 5,4 and 3,7% of the GDP, recovering since 2013 on the territory of nominal convergence.

- Bulgaria is, most likely, the country with the strongest fiscal consolidation in Eastern Europe, managing to recover and to come back on the territory of nominal convergence since 2011, and with budget surplus for 4 consecutive years, in the interval 2016-2019.

- Starting 2016, European public finances evolved consistently on a trend of budget surplus. In 2019, the year before the corona-crisis, 17 member states were recording budget surpluses, and only Romania had a deficit of over 3% of the GDP. The European Union was thus becoming global champion in fiscal consolidation.

- In 2021, the first year after the corona-crisis, the estimations regarding budget deficits share a striking resemblance with the situation of public finances in 2010 – the first year after the peak of the financial crisis. The significant difference is the very different trajectory of the economic growth, which seems to recover uniformly after the corona-crisis.

However, the preoccupation for decreasing the budget deficits in the post-crisis years, especially in the context of the growing burden of the public debt at the level of the EU.

The map of the public debt and layers of sustainability

The 2008-2009 crisis has been assimilated, through its financial implications, with the so-called “sovereign debt crisis”, which became a threat to the institutional establishment of the EU itself. It is iconic, in this respect, the case of the PIIGS countries (Portugal, Italy, Ireland, Greece, Spain), utilized as “ no alternative” argument in the favour of austerity policies. The map of public debts becomes, thus, relevant for post-crisis economic policies and for their long-term implications.

The map of public debt shows clearly the fact that more and more EU countries advanced in the category of the countries with high public debts, and the ones with low debts became less and less.

- Before the crisis, only Italy and Greece had public debts of over 90% of the GDP. After crisis, 8 countries “woke up” with public debts of over 90% of the GDP, out of which Portugal, Italy and Greece reached, for several years, over 120% of the GDP.

- Compared to the situation before the crisis, the category of the countries with a public debt between 60 and 90% of the GDP grew by 8 countries, therefore respecting the threshold of 60% of the GDP, according to Copenhagen criteria, becomes the exception from the rule.

- The number of countries with debts smaller that 30% decreased from 10, in 2007, to only 3, as a result of the financial crisis. Estonia, Luxemburg and Bulgaria constantly dominate the top of the countries with the smallest debts.

- Through the consolidation of public finances in 2016-2019, several countries entered “the green”, with debt level under 60% of the GDP. The Netherlands, Finland, Germany, Ireland returned thus to the nominal convergence criteria.

- Once with the severe deterioration of the public finances in 2020, during the upcoming years the cycle of the growth of public debts will repeat itself, which again raises the problem of budget adjustments and adjustment of how much the burden of public debt can be tempered.

In this respect, the adjustments of the budget balance are especially relevant, on the one hand, as a hint of the intensity of the deterioration of public finances during years of crisis and, on the other hand, as an assessment of the fiscal consolidation effort in the post-crisis years.

The map of budget adjustments and fiscal consolidation effort

The map of budget adjustments highlights, therefore, the countries which resorted to a more consistent fiscal consolidation effort, respectively the countries which took the road of a gradual fiscal consolidation, rather as an effect of economic recovery, and not necessarily as an public finances “inning” policy, through austerity measures.

Firstly, it is important for us to understand if the post-crisis fiscal consolidation effort led to a boost of sustainability in the evolution of public debts, without affecting the short-term economic growth, by the decrease of the demand.

Secondly, the comparative analysis of the two critical moments, the corona-crisis in 2020 and the economic-financial crisis in 2008-2009, would highlight how appropriate it would be to continue such a budget-adjustment policy pattern post 2020.

The map of budget adjustments highlights, through blue and green areas, the hierarchy of the countries with positive adjustments of the budget balance, respectively the countries which had a fiscal consolidation, by reducing the budget deficit year by year. The orange and red areas highlight, in hierarchical order, the countries whose budget deficits grew from one year to another.

Also, for 2009 and 2020, the reference years of the two crises, the explosive leap of the budget deficits is highlighted through adjusting the representation to the intensity of the deficit growth, associated with specific colours. (see legend)

- Thus, in 2009, the critical year of the financial crisis, only 7 member states recorded growths of the budget deficit of over 6 percentage points, in comparison to the previous year. In 2020, the year of the corona-crisis, only 3 member states seem to record growths of the budget deficit smaller than 6 percentage points, in comparison to 2019.

- In 2009, the deterioration of the public finances was the result of the economic recession and of the associated fall of the budget income, the policy preoccupation in the post-crisis years being with fiscal consolidation and recovery in the convergence criteria.

- Between 2010 and 2018, on the map of budget adjustments prevails, in general, the fiscal consolidation effort, the majority of the EU countries evolving “on the blue” and “the green”. 2019, through the outpouring of the fiscal consolidation trend and associated with the map of the growth, seems to indicate the slowdown of the economic expansion, the sign of a new cyclic evolution.

- Greece, Estonia, Lithuania, Romania and Spain are the countries which, immediately after 2009, moved on “the blue” and experimented the most intense fiscal consolidation, through adjustment measures of the budget deficit with about 2 percentage points more than in 2010.

- The countries whose budget deficits continued to deepen in 2010 too, like Poland, Germany, Portugal, Ireland, moved on “the blue” in the following year, in 2011 taking the road of public finances consolidation.

- Ireland, for example, has been for 4 years consecutively, between 2007 and 2010, the champion of budget deficits. However, since 2011, Ireland has moved on “the blue” for 5 consecutive years, managing to consistently return to nominal convergence, since 2015.

- Romania placed, since 2010 until 2015, on “the blue” and “the green”, so on the road of an intense fiscal consolidation. Starting 2016, on the background of the reduction of taxes and duties, the situation of public finances deteriorated continuously and aggressively.

- In 2020, the boom of budget deficits is also the result of both the lockdown state of the economy, and of the strong growth of budget expenses (sanitary expenses, meant for fighting the COVID-19 pandemic, but also anti-crisis expenses, meant for the support of some economic sectors, through state aid, paying technical unemployment).

- In 2021, for the majority of the EU states are estimated budget consolidation efforts of 2-3 percentage points of the GDP in comparison to the previous year. On the one hand, the expenses with sanitary destination will decrease gradually and, on the other hand, the economic recovery will diminish, naturally, the deterioration of public finances.

From this point of view, the analysis of macro adjustments given the two crises demand a cautious comparative perspective, for nuances relevant to the solution plan.

Mirrored crises – different causes, different manifestations, imbalances to match

For the accuracy of the conclusions, it is important to understand that the two crises analysed have neither identical causes or manifestations. The 2009 moment and the 2020 moment are, simply, from different films, so they need to be viewed and treated differently.

The crisis in 2008-2009 was before all a financial one, therefore economic by nature, this meaning the textbook manifestation of the “economic cycles” based on the strongly pro-cyclical expansion of monetary policies.

In return, the economic crisis of year 2020 is the anticipated and assumed result of the COVID-19 pandemic, being a consequence of lockdown measures, not the reflection of some “disorders” in the economic mechanisms per-se.

Also, the financial crisis in 2009 manifested with different intensities from one country to the other, while the corona-crisis happened relatively uniformly, with a high rate of simultaneity and similarity, at least in the case of the EU countries.

At the same time, it seems like there will be substantial differences in the economic recovery plan. The financial crisis in 2009 dissipated relatively slowly, on the course of 4-5 years. The austerity measures, adopted under the burden of sovereign debts, also mattered.

In the case of the corona crisis, as sanitary coercion measures diminish, and as conjugated effect of vaccination against COVID-19 campaigns, the economic prognosis accreditates a relatively fast recovery.

The recovery and resilience mechanism, in parallel with the suspension of budget deficit coercions, indicate a clear difference in the economic treatment.

If to the 2009 crisis we reacted with coercion measures, given the financial causes of it, the corona-crisis demands measures to stimulate the economy, context in which the financial system becomes, this time, part of the solution.

But, even if the economic recovery is convergently supported on an European level, the pressure of the macro imbalances on a national level will not dissipate by itself, maybe even on the contrary in the case of some countries that lack an appetite for reforms.

Romania at the extremes: from austerity to excessive deficit

Looking back, we can draw a few important conclusions regarding Romania.

Firstly, we can say that, in 2010, Romania experimented one of the most severe fiscal consolidation efforts of all EU countries, even though the burden of public debt still had not become straining, as seem to evolve things in the case of the corona-crisis. Therefore, “the austerity package” applied by Romania, through its budget adjustments in 2010-2011, seem to have been disproportionate.

Secondly, if we relate to the rhythm of the economic growth in the post-austerity years, the budget adjustments don’t seem to have held it back, unlike in the case of other countries. Thus, from the bottom of the ranking, Romania pretty quickly jumped on the “yellow”, in 2011-2012, and then on the “blue” – to growth rates of over 3% of the GDP in 2013-2014. These evolutions seem to reflect, unlike other countries, also the absence of significant coercions regarding the public debt, at the time.

We draw however an important conclusion, almost a historical irony as far as Romania’s passage through the crisis is concerned. Both crises, the financial one and the corona-crisis too, found Romania as unprepared from the perspective of sustainability of the economic journey and of the fiscal intervention space.

And before the financial crisis in 2008-2009, and before the corona crisis in 2020, Romania was posing as economic growth champion. On the map of economic growth, in the years before the crises, Romania was on the “blue”, among the first countries in the EU hierarchy. However, on the map of budget balance, in the same years before the crises, Romania was on the “orange”, with deficits of over 5,4% in 2008 and 4,4% of the GDP in 2019, at the bottom of the rankings of the EU countries. And this “deficit growth” has, though, little in common with the principles of sustainability!

From here we deduce that there is something wrong in the development model of Romania in the last years, something that can be changed only through an appeal to responsabilty, long-term vision and reforms for sustainability.

It is a fact that Romania has never been rated as a country that facilitates the financing of financial imbalances in times of crisis, just when it is most needed. For an overview, let’s remember that on the background. Of the 2008-2009 crisis, despite a significant fiscal consolidation effort in 2010-2011, Romania’s public debt grew, in just 5 years, from 12% of the GDP in 2008 to 37% of the GDP in 2012. This is the most significant growth of the public debt in those years.

As an irony of economic history, the austerity measures adopted by Romania in 2010 asked for a political revenge, obtained as the populist measures in 2017-2019, some of them initiated in 2015 – through a huge fiscal relaxation.

The consequence was that the painful fiscal consolidation effort in the crisis years, unjust to the Romanians who endured the austerity bill, went down the drain unjustly, during the years of economic growth. Thus, in 2020, Romania was again found unprepared by the corona-crisis, lacking the budgetary space so necessary for managing the sanitary crisis and for supporting the economy.

Romania at the extremes is the image of our economic evolution between 2009 and 2020 – the calendar thresholds of the two crises. The Romania after 2009 meant one of the most severe austerity packages, while the Romania before 2020 meant the highest budget deficit in the EU. Between the two crises, Romania went from austerity to excessive deficit, which represents by far the most constant economic evolution in the EU.

This is exactly why the political cycle of the following years and the corona-crises must change economic policies significantly, through responsibility for the future.

Prospective conclusions to the corona-crisis and economic politics decisions

Once with the mitigation of the sanitary crisis, economic perspectives will also return to a positive territory, and the peak of budget imbalances from 2020 will be progressively reabsorbed, on the background of an economic growth, most likely starting with the second trimester of 2021. However, we are still left with a series of challenges.

- In 2020, Romania’s economic downturn will be a moderate one in comparison to the evolutions of other countries. Even if Romania did not record a V-recovery, according to the textbook definition based on the quarterly dynamics, in 2021 there are good premises for an economic growth of over 4%, according to present estimations, and in 2022 we will be able to return to the economic level before the corona crisis.

- Given the defining differences – on the level of causes and economic manifestations – between the corona-crisis and the financial crisis a decade ago, we can estimate a relatively faster recovery of the public finances situation, and the fiscal consolidation will need to be less heavy, as budget adjustments and social expenses.

- In the economic policy decision plan and regarding the need for fiscal consolidation, a “wait and see” type of approach can make sense, at least regarding the sanitary uncertainties which strongly influence the economic sentiment.

- But structural reforms and fiscal consolidation cannot be delayed anymore, because Romania has historical slippages to recover from, before the COVID-19 crisis, and which cannot continue forever, given that present estimations already indicate that in 2021 we could reach a public debt worth 50% of the GDP.

- The middle way for Romania would be represented by an adjustment of the budget deficit on a 7-5-3 type of trend, according to the objectives already announced, eventually with an ambition boost depending on the recovery of the economic growth. For example, and adjustment of approximately 2,5 percentage points, like the one prefigured in the budget for 2021, seems to be in line with an estimated dynamic of adjustments on a European level.

- One of the challenges of budgetary construction for 2021 aims at the degree to which nominal budgetary construction (cash and ESA) will represent a consistent adjustment and in structural terms, as an indicator of a healthy fiscal consolidation.

- It is already imperative to increase the efficiency in collecting budget incomes, through a digitalized fiscal administration, which to attract discipline and transparency in the fiscal system. Optimizing budgetary expenses is also indispensable, through objective mechanisms for prioritizing and efficiency in using public money.

- Romania needs a definite package of structural reforms, especially in the health, education and administration systems, legislative solutions in the field of public acquisitions and European funds, but also a strategic vision regarding the architecture in the financial system, as an essential factor in supporting big investment projects.

- The consistent European fund package from the programming period 2021-2027, including the funds allocated through the Mechanism of recovery and resilience, are the “cheapest” and secure finance source for the necessary investments and reforms, and Romania has the duty to fully take advantage of these opportunities.

- The success of the reforms and of the economic recovery will be significantly influenced by the coherence of the decisions and the correlation of the set of fiscal-budgetary and monetary policies, for keeping the trust of the investors and of the business environment.

- The manifestation of a partnership between the state and the business environment is also essential, built on the principles of honesty, transparency and dialogue, partnership which becomes a condition sine qua non for the efficacy of the reforms and of the economic policies.

- The economic policy measures need to be set cautiously, including the thought of a future crisis, so that some of the solutions to the corona-crisis don’t somehow potentiate the causes of a new economic crisis, maybe belated by the emergence of the COVID-19 crisis.

- On a global level, the economy will continue to internalize structural changes and macroeconomic adjustments, digital transformations and big technological progresses, and the corona-crisis thus becomes a lesson in adaptation and flexibility of the economy, in a disruptive regime.

(an article by Cosmin Marinescu)